No need for blood. Use ChatGPT on CEO.ca

Is it feasible to use ChatGPT's Advanced Data Analysis to predict when a stock is at risk of undergoing a price correction, solely based on the analysis of online discussion boards?

To put this concept to the test, let's consider a real-world example. I have randomly selected a volatile stock listed on the Toronto Stock Exchange (TSX): Discovery Silver Corp (DSV.to). The next step in our investigation involves scrutinizing the conversations on the discussion forum dedicated to this particular stock: https://ceo.ca/dsv

While there could have been a more elegant approach (such as using web scraping), I manually copy and paste years' worth of discussions into a Word document. I then turn to ChatGPT and upload my poorly-formatted Word document for analysis.

Please review this table of time-stamped messages and analyze them to graphically depict the mood over time. Time should be on the X-axis, and the mood—ranging from utmost confidence to extreme despair—should be on the Y-axis.

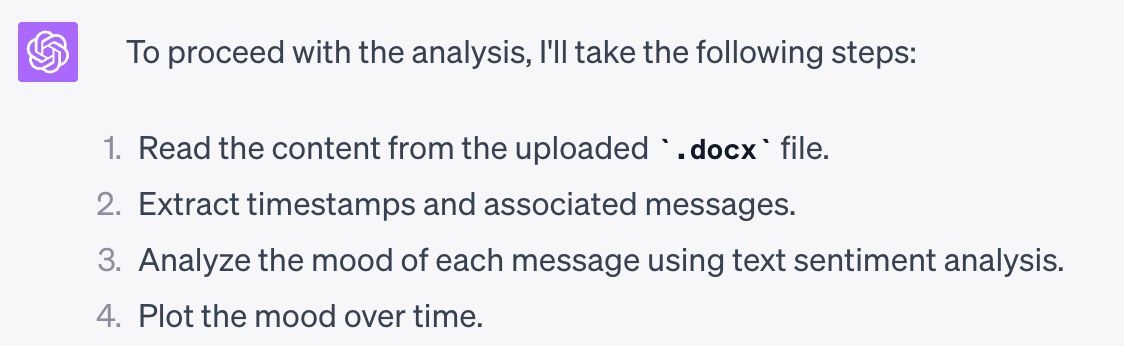

There are multiple methods to analyze mood. We will employ a straightforward sentiment analysis technique using the TextBlob library. This library offers a simple API for common Natural Language Processing (NLP) tasks, including sentiment analysis. Here are some other options:

- VADER (Valence Aware Dictionary and sEntiment Reasoner): Specially designed for sentiment analysis, including handling idiomatic expressions and slang.

- AFINN: Specifically tailored for microblogs like Twitter.

- SentiWordNet: Leverages the WordNet lexical database, assigning each WordNet synset three sentiment scores: positivity, negativity, and objectivity.

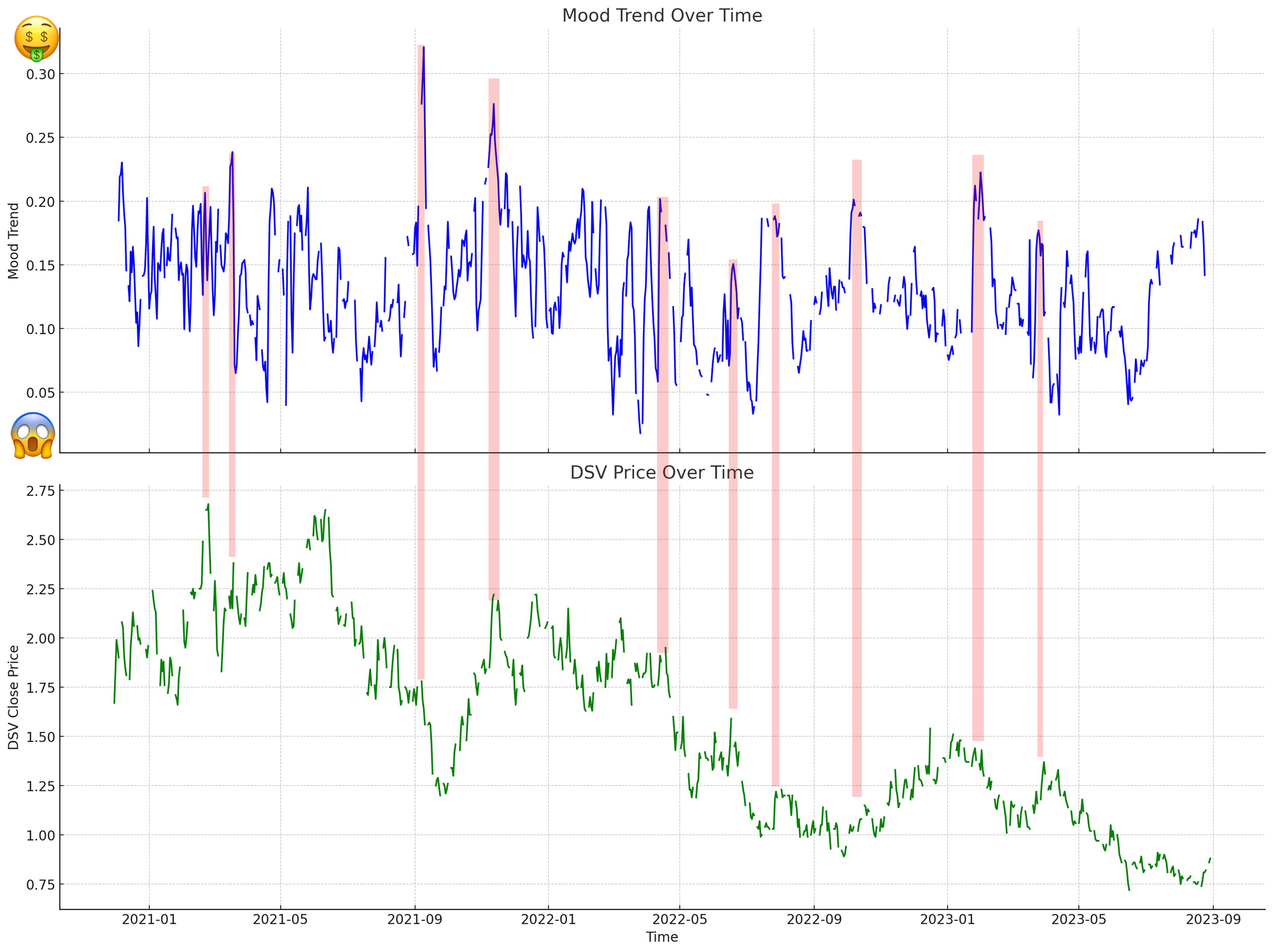

In short order, ChatGPT delivers its analysis of thousands of messages from the Discovery Metals forum:

Now, I upload the complete dataset for the stock, using this (free): https://finance.yahoo.com/quote/DSV.TO

Next, I instruct ChatGPT to generate a graph based on my preferences:

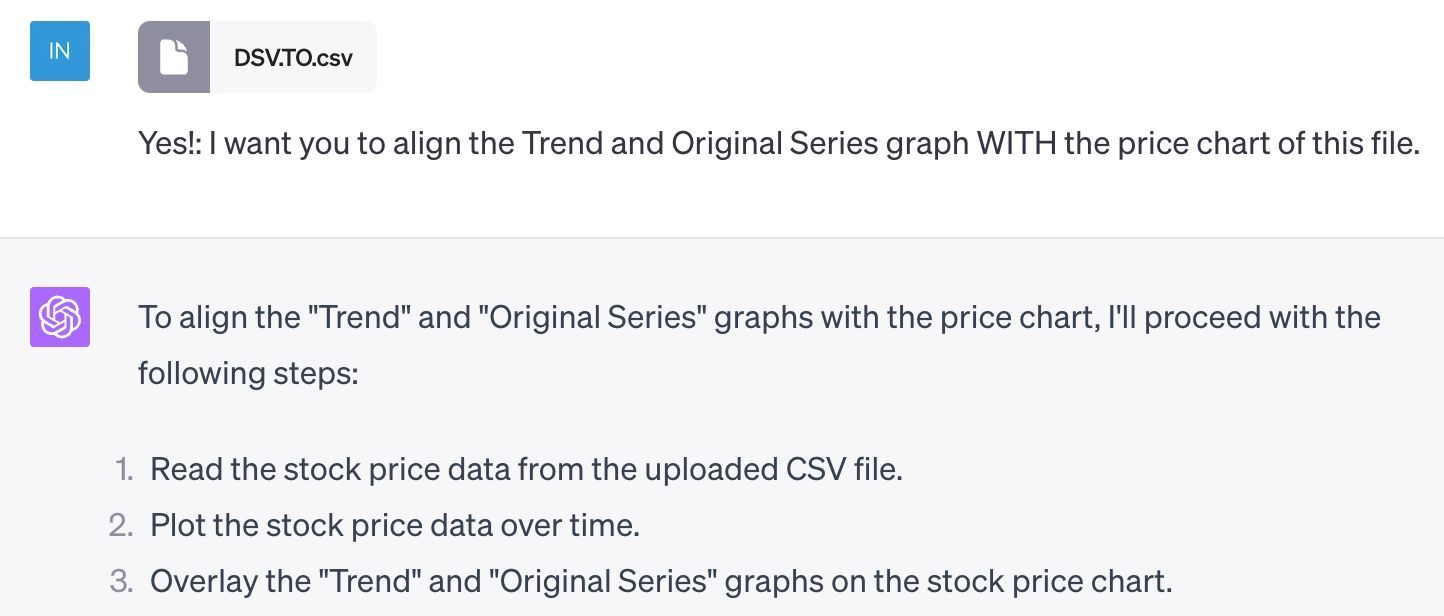

Fascinating, isn't it? ChatGPT's analysis shows that it's when a sense of euphoria—or greed—is prevalent on CEO.ca that you're most likely to lose your money. Conversely, the opposite is true.

My quick demonstration underscores the substantial inherent worth of proprietary data. Consequently, I would strongly recommend the strategic pursuit of an independent sentiment tracking system.

Baron Rothschild is famously quoted as saying, 'The time to buy is when there's blood in the streets.' Rothschild made his fortune by buying into the panic that followed the Battle of Waterloo against Napoleon.

He would have appreciated using ChatGPT on CEO.ca instead of waiting for blood.

👋🏻 Thanks!

- Partager sur Twitter

- Partager sur Facebook

- Partager sur LinkedIn

- Partager sur Pinterest

- Partager par Courriel

- Copier le lien

Res Novae Bulletin

Inscrivez-vous à la newsletter pour recevoir les nouvelles infos.